Most recent free reports and opinion pieces

Japan Goes for Growth to Support Nature-Based Projects

Outlook and Assessment of Real Nature-based Removals

The First CCP-Qualifying Projects — the VCM Steps on the Gas

Podcast: The Best Time to Plant a Tree Is 20 Years Ago

How we help our customers

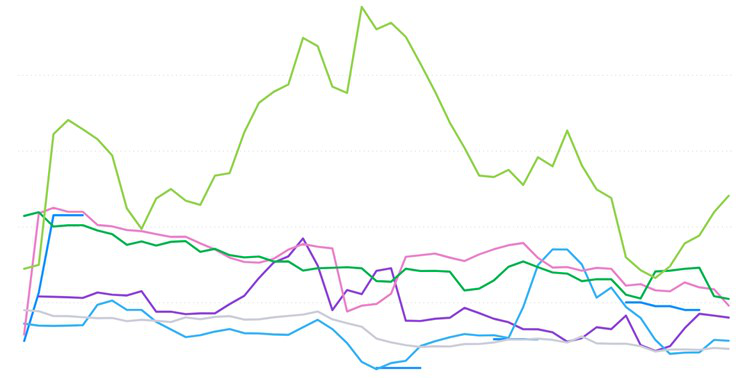

How much do carbon credits cost today and how have prices changed?

Weekly price updates across all project / contract types and vintages, drawn from a wide range of relationships with market participants and exchanges. Our prices are transparent with a clearly defined methodology that allows investors and traders to track prices with confidence.

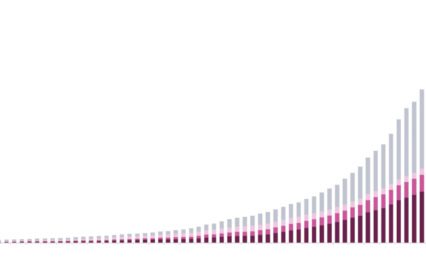

Which companies have set climate targets, how many carbon credits are they buying and how many they will need in the future?

The tracking of climate commitments of over 6,500 companies, covering their scope 1, 2 and 3 emissions, emission reduction pathways, carbon credit use and projections of future credit needs.

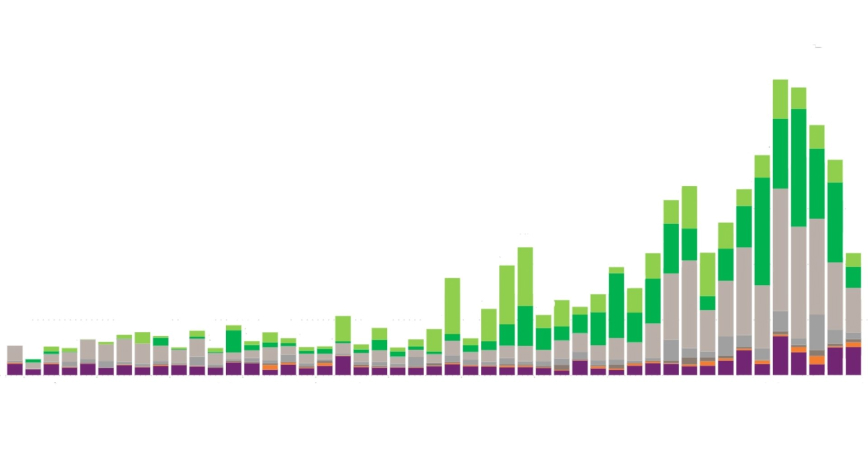

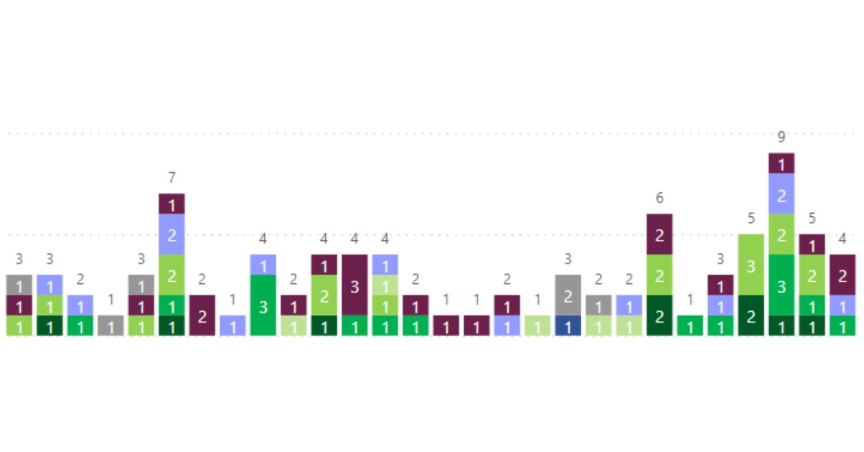

What type of carbon credits are being created and used today, how will this change in the future?

The market’s most comprehensive analysis of credit issuances, retirements, surpluses, together with project details, performance statistics and integrity ratings. Analysis of future pipeline activity and forecasts of future issuances.

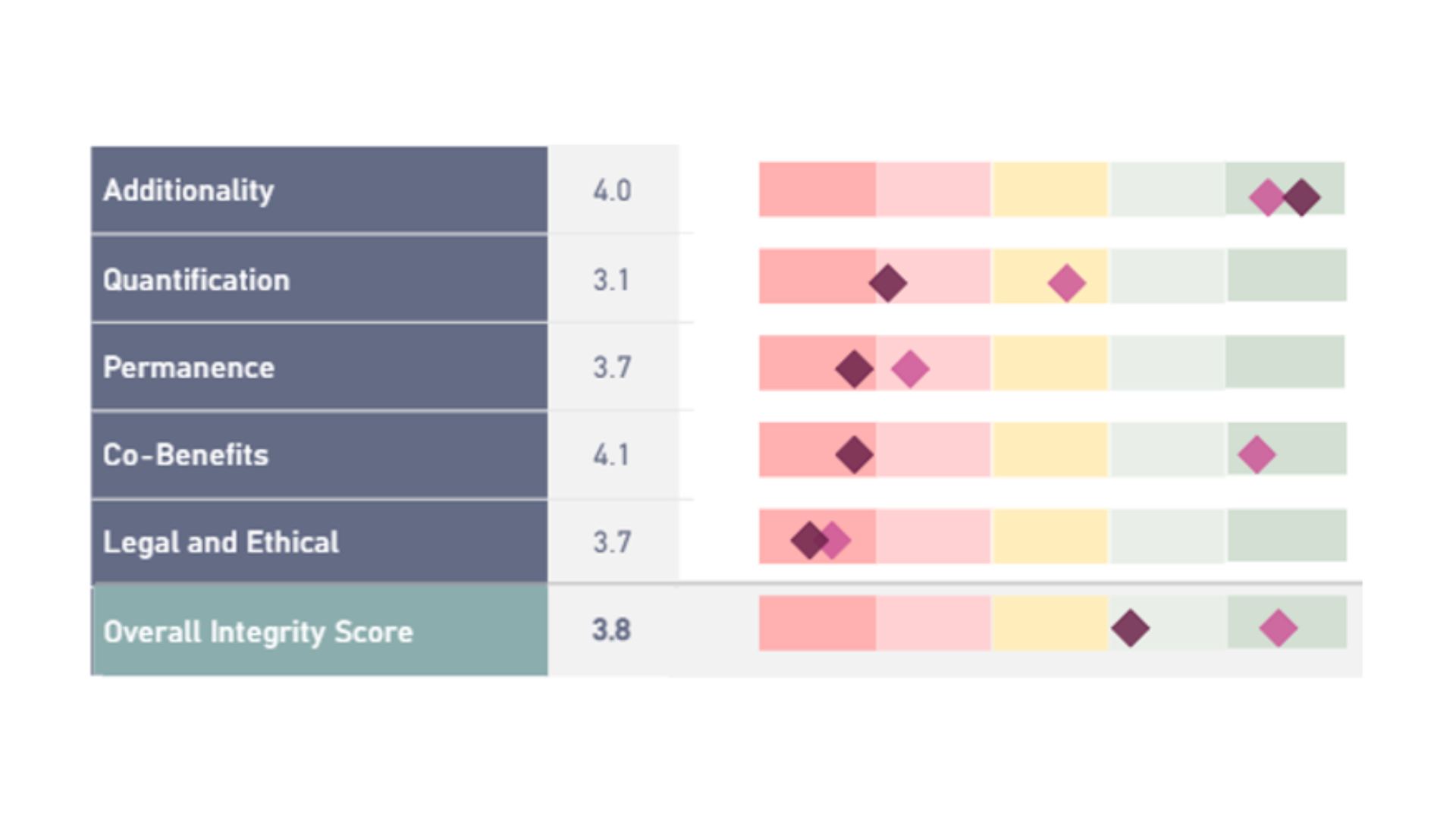

Which carbon credits have the highest integrity and greatest protection from reputational risk?

Comprehensive and consistent assessment of carbon credit integrity, covering over 4,000 projects. Our robust, independent and transparent methodology assesses projects on their additionality, quantification, permanence, co-benefits, and legal / ethical risks, tailored to the criteria that matter most to you.

How will new policies and guidance affect corporate climate commitments and the use of carbon credits?

Complete analysis of the latest guidance affecting corporate climate commitments, disclosure requirements, emission mitigation strategies and the use of carbon credits. Up-to-date databases of organisations, consultation documents and Trove opinion pieces on the voluntary carbon market.

How will the price of carbon credits change in the future?

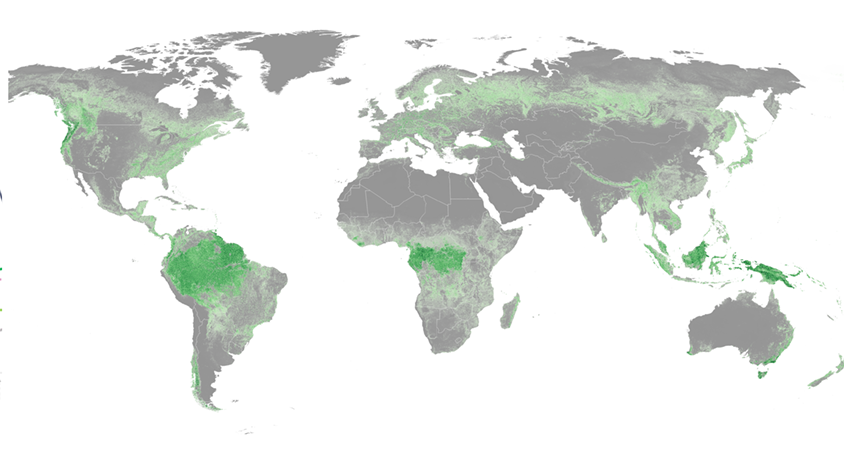

Unique models to project future carbon credit prices. Long term scenarios for the global and North American carbon markets based on geospatial / economic analysis of future carbon credit supply, together with forecasts of future credit demand. Short term forecasts based on recent price trends and projections of demand and supply.